|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Harp Home Mortgage Interest Rates: Key Insights and ConsiderationsIntroduction to Harp Home Mortgage Interest RatesHARP, or the Home Affordable Refinance Program, was introduced to help homeowners refinance their mortgages at lower interest rates. This initiative aimed to assist those who were underwater or nearly underwater on their loans, providing a path to more manageable payments. Factors Influencing Interest RatesSeveral factors can affect the interest rates offered through HARP. These include the borrower's credit score, the loan-to-value ratio, and prevailing market conditions. Understanding these elements is crucial for homeowners looking to refinance. Credit Score ImpactA higher credit score can lead to more favorable interest rates. Lenders typically offer better rates to those with strong credit histories, as they are perceived as less risky. Market ConditionsInterest rates are also influenced by the broader economic environment. Factors such as inflation, employment rates, and Federal Reserve policies play significant roles in determining market conditions. Benefits of Refinancing Through HARP

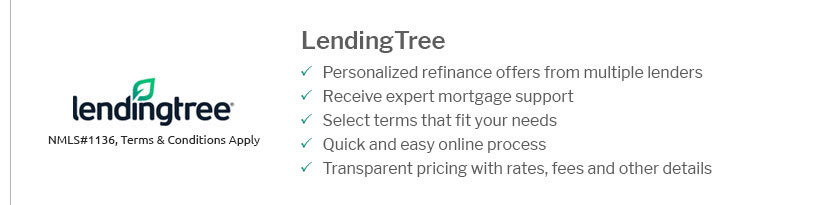

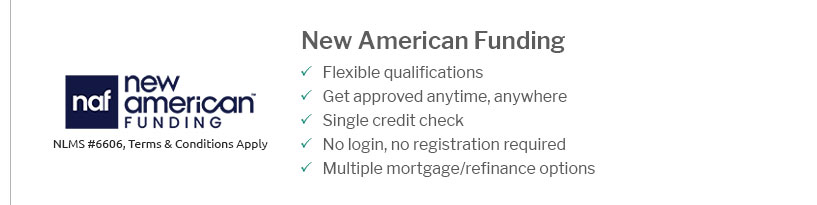

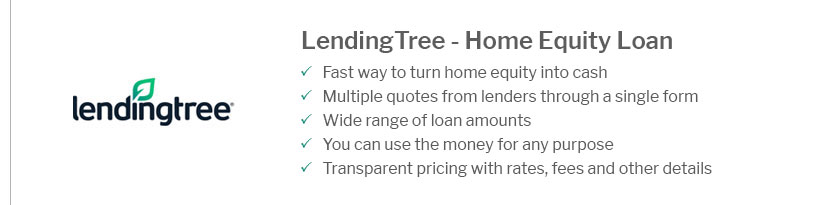

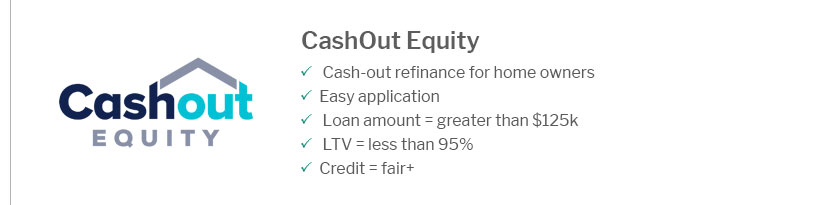

For those exploring refinancing options, it's wise to consider engaging with popular mortgage lenders to find competitive rates and terms. Potential ChallengesWhile HARP provides numerous benefits, there are also potential challenges. These can include eligibility requirements and lender-specific stipulations. Eligibility CriteriaNot all loans qualify for HARP refinancing. It's essential to check if your current mortgage is owned by Fannie Mae or Freddie Mac and was originated before May 31, 2009. Comparing HARP with Other Refinancing OptionsWhen considering refinancing, it's beneficial to compare HARP with other available options. For some, a lowest interest rate property loan may offer more suitable terms, depending on individual circumstances. FAQs

https://www.ramseysolutions.com/real-estate/harp-program?srsltid=AfmBOorxYz0KNJdoDV3vnVquS9y5gkEof9XE5Zq3-ewwNhvyL6LLS5gD

... Home Affordable Refinance Program (HARP) to refinance your underwater mortgage ... mortgage at around a 6% interest rate. That was a good ... https://www.urban.org/urban-wire/streamlined-home-refinancing-program-would-lower-monthly-payments-and-prevent-defaults

Rigorous studies have estimated that this program, by reducing borrowers' monthly mortgage payments, reduced the default rate on these mortgages ... https://themortgagereports.com/19519/harp-mortgage-rates-eligibility-fhfa

HARP Mortgages Can Save You $60,000 Or More. If your home has lost value since its purchase, the government wants to help you refinance. As part ...

|

|---|